Remote bookkeeping services are the process of managing a business’s financial records from a location outside the traditional office environment. Instead of having an in-house bookkeeper, businesses can hire a remote staff accountant who uses digital tools to provide bookkeeping services from anywhere in the world.

This approach leverages the power of the internet and cloud-based software to ensure that financial data is accurate, up-to-date, and accessible.

Key Features of Remote Bookkeeping Services

Remote bookkeeping services come with several key features that make them an attractive option for businesses:

- Real-Time Access: Financial data is updated instantly when using remote bookkeeping services. This means you can access the most current information about your business’s financial health at any moment, from any device.

- Cloud-Based Solutions: Most remote bookkeeping services use cloud-based software like QuickBooks Online. These platforms store your data securely online, ensuring it’s always available when you need it and protecting against data loss.

- Automation of Tasks: Remote bookkeeping services leverage automation to handle routine tasks such as data entry, invoice creation, and expense tracking. This reduces the risk of errors and saves significant time, allowing the remote staff accountant to focus on more critical financial analysis.

- Cost-Effective: By outsourcing bookkeeping remotely, businesses can save on overhead costs associated with hiring full-time, in-house staff. Remote services can be scaled up or down based on your needs, offering flexibility and cost savings.

- Enhanced Security: Remote bookkeeping services employ advanced security measures like encryption, two-factor authentication, and regular backups to protect your financial data. This ensures that sensitive data is secure and kept private.

- Scalability: Whether you’re a small startup or a growing enterprise, remote bookkeeping services can scale with your business. You can easily adjust the level of service to meet your changing needs without the hassle of hiring and training new staff.

- Expertise and Support: Remote bookkeeping services provide access to a team of experienced professionals who stay up-to-date with the latest accounting standards and regulations. This ensures that your financial statements are managed correctly and in compliance.

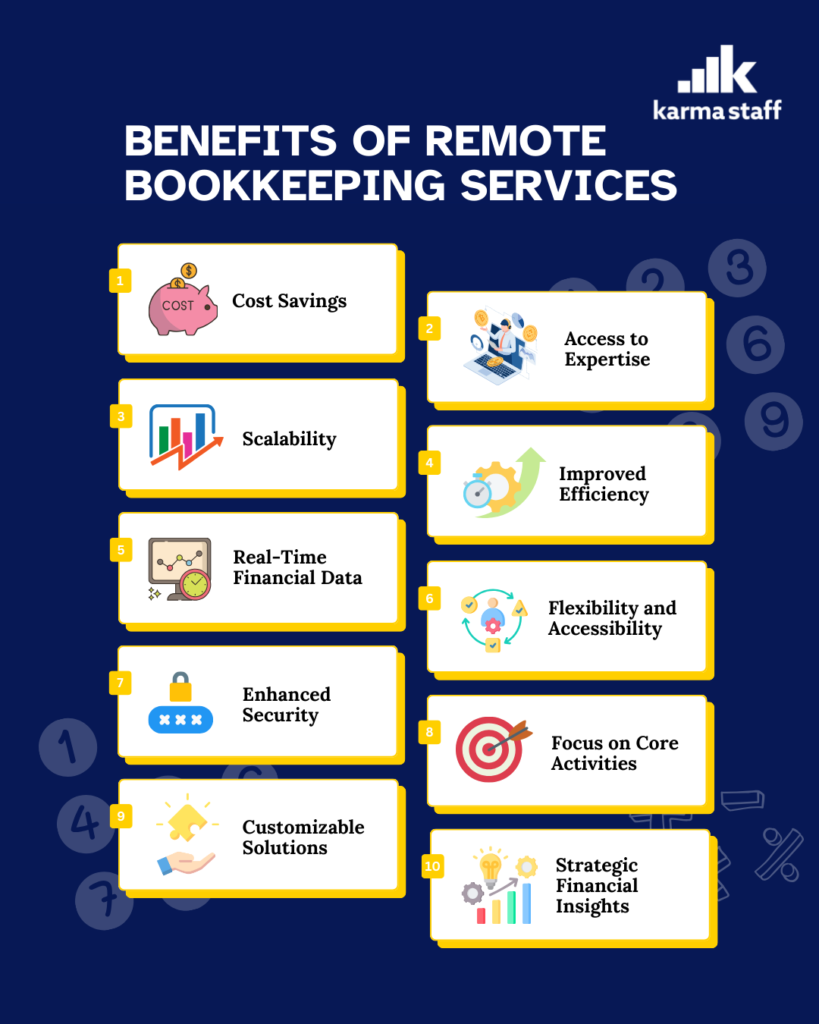

Benefits of Remote Bookkeeping Services

- Cost Savings: Remote bookkeeping services eliminate the need for physical office space and associated overhead costs, such as rent, utilities, and supplies. Additionally, these services offer flexible billing options, including bill pay, hourly rate, fixed rate, and charge by the hour, to suit various needs and budgets.

- Access to Expertise: Remote bookkeeping services connect you with highly skilled and experienced professionals who stay updated with the latest accounting standards and regulations, ensuring your financial records are accurate and compliant.

- Scalability: Remote bookkeeping services can easily scale up or down based on your business needs, allowing you to adjust the level of service without the hassle of hiring or laying off staff.

- Improved Efficiency: Leveraging advanced software and automation tools, remote bookkeeping services reduce manual tasks such as data entry, reconciliation, and invoicing, saving time and minimizing the risk of errors.

- Real-Time Financial Data: With cloud-based basic bookkeeping services, your financial data is updated in real-time, providing you with immediate access to the latest financial information and enabling quicker, more informed decision-making.

- Flexibility and Accessibility: Remote bookkeeping services allow you to access your financial data anytime, anywhere, making it ideal for businesses with global operations or remote teams.

- Enhanced Security: Remote bookkeeping services implement robust security measures, such as encryption, two-factor authentication, regular backups, and compliance with data protection regulations, ensuring your financial data is protected.

- Focus on Core Activities: By outsourcing bookkeeping services, you and your team can focus on running and growing your business, improving productivity, and allowing you to allocate resources more effectively.

- Customizable Solutions: Remote bookkeeping services can be tailored to fit your specific business requirements, providing specialized reporting and industry-specific accounting practices to meet your unique needs.

- Strategic Financial Insights: A remote staff accountant provides detailed financial analysis, identifying trends and offering strategic advice that helps you optimize cash flow, manage expenses, and plan for future growth, ultimately leading to better business outcomes.

How to Pick a Reliable Remote Bookkeeping Service

Choosing the right remote bookkeeping service is crucial for your business’s financial health. A perfect partner will not only handle your bookkeeping efficiently but also provide valuable insights and support. Here’s how to evaluate providers and what to look for to ensure you make the best choice.

Qualifications and Expertise

- Certifications and Credentials: Look for providers with certification from a recognized institution and qualifications. These credentials ensure that the remote staff accountant has the necessary knowledge and skills to manage your finances accurately.

- Industry Experience: Select an organization with prior expertise in your particular field. Industry-specific knowledge means they understand the unique challenges and requirements of your business, leading to better service and advice.

Range of Services

- Comprehensive Offerings: Evaluate the range of services offered by the provider. Ideal remote bookkeeping services should cover all aspects of bookkeeping, including payroll, tax preparation, financial reporting, and more.

- Customization: Make sure a provider can customize their offerings to fit your unique requirements. Customizable solutions allow for a more personalized and effective approach to managing your finances.

Technology and Tools

- Advanced Software: The provider should use advanced bookkeeping software that integrates seamlessly with your existing systems. This ensures efficiency and accuracy in managing your financial data.

- Automation Capabilities: Look for providers that leverage automation to handle routine tasks. Automation reduces manual errors and saves time, allowing for more focus on strategic financial management.

Security Measures

- Data Protection: Ensure the provider uses robust security measures, such as encryption and secure data storage, to protect your financial information. This is essential to stop illegal access and data breaches.

- Compliance: The provider should comply with relevant data protection regulations, ensuring that your data is handled according to legal standards.

Communication and Support

- Responsive Support: Choose a provider with a reputation for responsive and reliable customer support. This ensures that any issues or queries are addressed promptly, minimizing disruption to your business.

- Regular Updates: The provider should offer regular updates and transparent communication regarding your financial status. Clear and consistent communication helps you stay informed and make timely decisions.

Cost and Value

- Transparent Pricing: Seek out firms who have clear pricing policies. Ensure there are no hidden fees and that you understand exactly what services are included in the cost.

- Value for Money: Think about the total value that the full-service bookkeeping offers. While cost is important, the quality of service, expertise, and additional benefits should justify the expense.

Client Reviews and Testimonials

- Reputation: Research the provider’s reputation through online reviews and testimonials. Positive feedback from current and past clients can indicate reliability and quality service.

- Case Studies: Ask for case studies or examples of how the provider has helped businesses similar to yours. This gives you an idea of how well they can accommodate your particular requirements.

Trial Periods and Contracts

- Trial Options: Some providers offer trial periods or short-term contracts. This allows you to evaluate their service quality and fit for your business without a long-term commitment.

- Flexible Contracts: Ensure the provider offers flexible contract terms that can adapt to your changing business needs. This flexibility is essential for scaling services as your business grows.

Best Practices for Effective Remote Bookkeeping

Remote bookkeeping services offer efficiency and flexibility to businesses of all sizes. However, to maximize its benefits, it’s essential to follow best practices. Here are some key strategies to ensure effective remote bookkeeping:

- Use Cloud-Based Accounting Software: Choosing the right platform is crucial. Opt for cloud-based accounting software that allows you to access your financial data anytime, anywhere, ensuring that you have the most up-to-date information at your fingertips. With cloud-based software, your financial data is updated in real-time, providing you with the latest information needed for informed decision-making.

- Maintain Accurate Records: Maintaining accurate records is fundamental to effective bookkeeping. Ensure all transactions are recorded promptly and accurately to prevent backlogs and errors. Regularly reconciling your bank and credit card statements to ensure your records match your actual financial activity is essential. This practice helps in identifying discrepancies early and maintaining the integrity of your financial data.

- Automate Routine Tasks: Automating routine tasks can save significant time and reduce errors. Use automated invoicing and payment systems to streamline cash flow management. Additionally, setting up recurring transactions such as monthly fees or subscription payments can save time and avoid errors. You can concentrate on more strategically important areas of your company with automation.

- Ensure Data Security: Data security should be a top priority. Make sure the passwords in your bookkeeping software are strong and unique, and that they are updated on a regular basis. Enhance security by enabling two-factor authentication to protect your financial data from unauthorized access. These security measures help in protecting your private financial data.

- Maintain Clear Communication: Clear and regular communication with your remote staff accountant is essential. Schedule regular check-ins to discuss your financial status and any concerns. Utilize online communication tools to stay connected and ensure effective collaboration. Good communication helps in maintaining transparency and addressing issues promptly.

- Stay Organized: Staying organized is key to efficient bookkeeping. Create a well-organized digital filing system for all your financial documents, using clear and consistent naming conventions for easy retrieval. Additionally, digitize and store copies of all receipts, invoices, and important financial documents in secure cloud storage. An organized system helps in quick access and better management of financial data.

- Monitor Cash Flow: Monitoring cash flow is crucial for small business sustainability. Keep a close eye on your expenses to manage cash flow effectively. Use budgeting tools to plan and control spending. Regularly update your cash flow forecasts to anticipate future financial needs and avoid cash shortages. Effective cash flow management ensures that your business can settle its debts and fund growth opportunities.

- Regularly Review Financial Reports: Regular review of financial reports is necessary for understanding your business’s performance. Analyzing financial trends over time helps in identifying areas of improvement and making informed business decisions. Regular reviews ensure you are on track to meet your financial goals.

- Ensure Compliance: It is essential to make sure that accounting rules and tax filing laws are followed. Stay updated on changes in regulations to avoid penalties. Consider hiring a qualified remote staff accountant to ensure your financial records comply with legal requirements. Compliance helps in maintaining the credibility and legal standing of your business.

- Seek Continuous Improvement: Continuous improvement is vital for maintaining effective bookkeeping. Invest in ongoing training for your remote staff accountant to stay updated with the latest tools and best practices. Regularly seek feedback from your remote staff accountant to identify areas for improvement and make necessary adjustments. Embracing continuous improvement ensures that your bookkeeping processes remain efficient and effective.

Transform Your Bookkeeping with Karma Staff

Enhance your financial management with Karma Staff’s expert remote bookkeeping services. Our highly qualified experts provide scalable and adaptable solutions that are customized to your company’s requirements. Utilizing the latest cloud-based accounting software, we ensure your financial data is secure and up-to-date.

Trust Karma Staff to provide cost-effective, reliable, and efficient bookkeeping support, so you can focus on growing your business. Contact us today to learn how we can enhance your bookkeeping tasks and drive your company’s growth.

FAQ

Q: What services does Karma Staff offer for remote bookkeeping?

A: Karma Staff provides comprehensive remote bookkeeping services including transaction recording, invoicing, financial reporting, and customized financial analysis. Our offerings are customized to fit the particular requirements of every company.

Q: What accounting software does Karma Staff use for remote bookkeeping?

A: We use premier cloud-based accounting software, including QuickBooks Online. These platforms enable real-time data access and seamless integration with your existing financial systems.

Q: How do I communicate with my remote bookkeeper at Karma Staff?

A: Communication with your remote staff accountant is facilitated through email, phone, video conferencing (e.g., Zoom, Microsoft Teams), and instant messaging platforms. We ensure regular updates and scheduled meetings to keep you informed and address any concerns promptly.

Q: Can Karma Staff’s bookkeeping services be customized to my business needs?

A: Yes, Karma Staff offers customizable bookkeeping packages tailored to your specific business requirements. Whether you need part-time support, specialized reporting, or industry-specific bookkeeping, we can adjust our services to fit your needs.

Q: How often will I receive financial reports from Karma Staff?

A: The frequency of financial reports depends on your agreement with us. Typically, we provide monthly bookkeeping reports, but we can also offer weekly or quarterly reports based on your specific needs and preferences.

Q: How do I get started with Karma Staff’s remote bookkeeping services?

A: Getting started is easy. Simply contact us to discuss your bookkeeping needs. We will assess your requirements, recommend a tailored service package, and guide you through the onboarding process.

Q: What if I encounter issues or need urgent assistance with my bookkeeping?

A: Karma Staff offers 24/7 customer support to address any issues or urgent queries promptly. Our dedicated support team is always available to assist you and ensure smooth bookkeeping operations.