For small businesses trying to stay competitive while managing time, cash flow, and operational efficiency, accurate financial tracking is no longer a luxury; It is essential. With daily business decisions depending on real-time insights, more owners are hiring remote bookkeepers to provide consistent, professional, and tech-driven financial support. Beyond convenience, these experts offer a deeper level of value that traditional methods rarely match.

The Hidden Risks of Traditional Bookkeeping Practices

Outdated bookkeeping practices can quietly hurt a business’s ability to grow and remain compliant. Many small business owners unknowingly limit their progress by sticking with manual or scattered financial systems. In fact, 82 percent of small businesses fail due to poor cash flow management, a problem often linked to disorganized or delayed financial tracking. These inefficiencies not only impact daily operations but also create serious risks during audits or tax season. Here are the key problems that traditional bookkeeping creates:

- Relying on paper invoices or spreadsheets that get misplaced or corrupted

- Delayed financial data that prevents real-time decision-making

- No backup for important documents during emergencies or audits

- Difficulty accessing financial records remotely

- Missed tax deadlines due to disorganized records

- Unclear visibility on cash flow or expense trends

Remote bookkeepers solve these problems with structure, automation, and expertise.

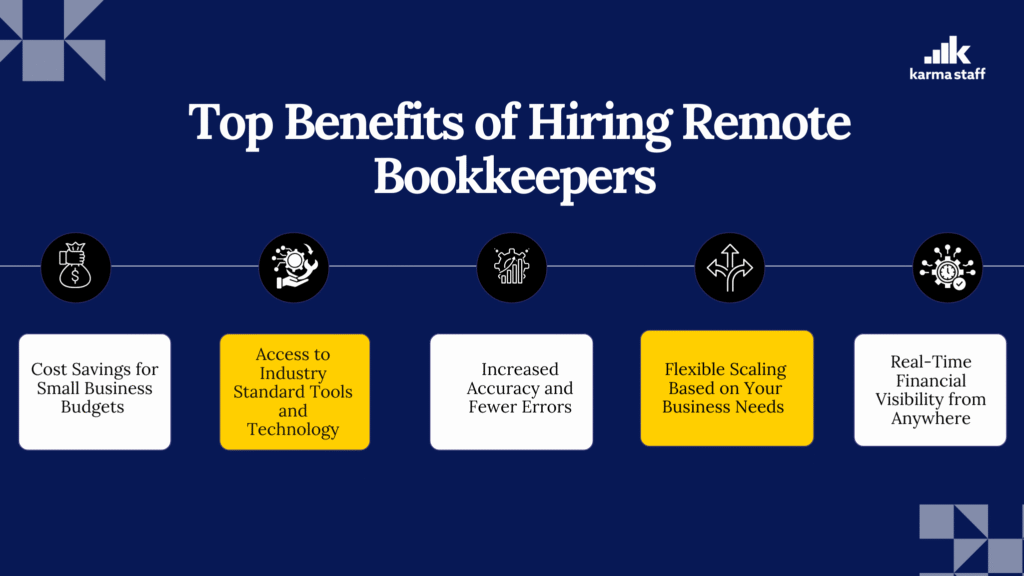

Top Benefits of Hiring Remote Bookkeepers

For small business owners, juggling daily responsibilities while trying to manage accurate financial records can be overwhelming. Here are the top benefits of hiring remote bookkeepers that make them a smart choice for long-term financial stability and growth.

1. Cost Savings for Small Business Budgets

Hiring full-time, in-house bookkeeping staff comes with high costs. Remote bookkeepers work on a contract or part-time basis, helping you avoid overheads like payroll, insurance, and equipment.

2. Access to Industry-Standard Tools and Technology

Most remote bookkeepers have access to premium tools like QuickBooks, Xero, and Zoho Books. These platforms offer automation, accuracy, and real-time data updates, which simplify bookkeeping for small business operations.

3. Increased Accuracy and Fewer Errors

By eliminating manual entry, remote bookkeepers significantly reduce the chances of mistakes in financial reports, reconciliations, and tax preparation. Clean records reduce audit risks and unexpected fines.

4. Flexible Scaling Based on Your Business Needs

Whether you are expanding or experiencing a slow season, remote bookkeepers can adjust their service level to match your current workload. You only pay for what you need, when you need it.

5. Real-Time Financial Visibility from Anywhere

Cloud-based services allow small business owners to access dashboards, reports, and transaction history at any time. This visibility is essential for better planning and improved bookkeeping for a small business strategy.

Why Remote Bookkeeping Is Key to Financial Stability

Compliance is not just about meeting deadlines but about maintaining structured and audit-ready records throughout the year. Here are four ways offsite bookkeeping enhances your preparedness and keeps your business aligned with financial regulations.

1. Consistent Record Keeping: Remote bookkeepers ensure financial data is updated and categorized properly, reducing the risk of errors during audits or tax filings.

2. Proactive Regulatory Monitoring: They stay informed about changes in local and federal tax laws, helping businesses stay compliant without having to track legislation independently.

3. Audit Readiness at All Times: Organized documentation and monthly reconciliations mean your business is always prepared to present clean books when requested by lenders or regulators.

4. Support with Government and Grant Reporting: For businesses applying for loans or grants, remote bookkeepers generate financial summaries and cash flow reports that meet funding criteria.

Remote Bookkeeping Versus Software-Only Solutions

Here is a simple comparison of how remote bookkeepers differ from using software tools alone:

| Feature | Remote Bookkeepers | Software-Only Solutions |

| Personal Guidance | Offers expert interpretation of financial data | Provides data only, without human input |

| Customization | Adapts processes to your specific business model | Limited to general templates and workflows |

| Error Detection | Identifies inconsistencies and resolves them manually | Depends on programmed rules and cannot explain errors |

| Regulatory Knowledge | Updates practices based on law changes | Update practices based on law changes |

Conclusion

Hiring remote bookkeepers allows small business owners to simplify their finances, reduce operational stress, and gain valuable insights into the numbers that drive growth. As the demand for digital-first solutions rises, remote services are not just convenient but necessary for modern bookkeeping for small business operations. By investing in the right professional support, businesses prepare themselves not just for stability, but for future success.

FAQs

Q1. What should I consider when outsourcing bookkeeping for my small business?

A: Look for professionals with proven experience, strong attention to detail, and knowledge of your specific industry. It’s also essential that they use secure, cloud-based technology to ensure data safety and easy access.

Q2. Can effective bookkeeping help prevent cash flow issues?

A: Absolutely. Accurate bookkeeping allows you to monitor income and expenses in real time, anticipate cash shortfalls, and make proactive financial decisions before problems arise.

Q3. How often should I review my bookkeeping reports?

A: Monthly reviews are recommended. Regular check-ins help identify trends, uncover discrepancies early, and support smarter budgeting and forecasting.

Q4. Can remote bookkeepers manage multiple accounts and vendors?

A: Yes. Skilled remote professionals are equipped to handle multiple accounts, vendors, and expense categories efficiently, using tools that ensure accuracy and organization.

Q5. Do I need to purchase bookkeeping software separately when working with a remote bookkeeper?

A: In most cases, no. Many remote bookkeepers provide access to professional-grade software through their own licenses, saving you time and money.